IMARC Group, a leading market research company, has recently released a report titled “Digital Payment Market Report by Component (Solutions, Services), Payment Mode (Bank Cards, Digital Currencies, Digital Wallets, Net Banking, and Others), Deployment Type (Cloud-based, On-premises), End Use Industry (BFSI, Healthcare, IT and Telecom, Media and Entertainment, Retail and E-commerce, Transportation, and Others), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the digital payment market report, trends, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

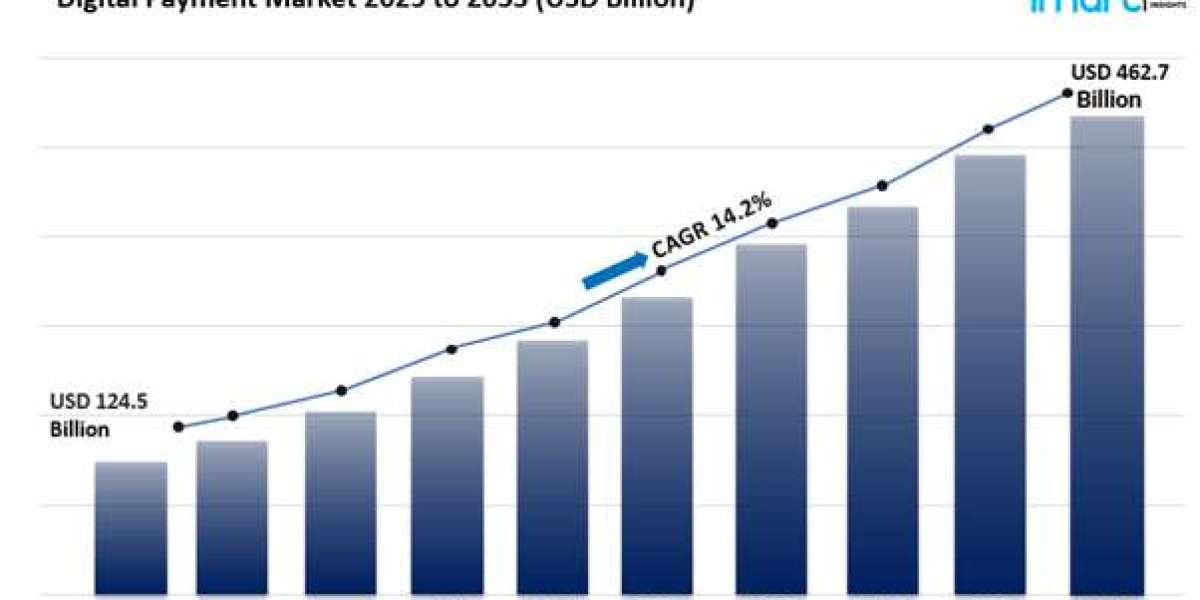

The global digital payment market size reached USD 124.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 462.7 Billion by 2033, exhibiting a growth rate (CAGR) of 14.2% during 2025-2033.

Request to Get the Sample Report:

https://www.imarcgroup.com/digital-payment-market/requestsample

Global Digital Payment Market Trends:

The growing acceptance of digital currencies like cryptocurrencies and stablecoins is significantly driving the expansion of the digital payment market. As these alternative forms of digital assets gain traction among businesses and consumers alike, they are reshaping financial transactions by offering decentralized, efficient, and transparent payment solutions.

Furthermore, the increasing adoption of Internet of Things (IoT) devices and smart appliances is fueling the market growth as they often integrate seamless, automated payment solutions directly into these devices to enhance convenience and efficiency in transactions.

Factors Affecting the Growth of the Digital Payment Industry:

- Ongoing technological advancements:

Technological advancements play a pivotal role in shaping the digital payment landscape. The evolution of technologies such as mobile wallets, Near Field Communication (NFC), and biometric authentication has significantly enhanced the convenience, security, and efficiency of digital transactions. Mobile payment solutions, enabled by smartphones and robust internet connectivity, have revolutionized the way consumers interact with financial services. These advancements have not only made payments more accessible but also fostered a shift towards cashless economies, driving the demand for digital payment solutions.

- Changing consumer preferences:

Changing consumer preferences are driving the adoption of digital payment methods. Modern consumers increasingly prioritize convenience, speed, and security when making financial transactions. Digital payments offer immediate processing times, enabling swift and hassle-free transactions compared to traditional payment methods like cash or checks.

Moreover, the integration of digital payment options into e-commerce platforms and retail stores has further heightened their adoption. Consumers now expect seamless payment experiences across online and offline channels, prompting businesses to integrate diverse digital payment solutions to cater to evolving consumer preferences.

- Supportive regulatory frameworks:

Supportive regulatory frameworks are instrumental in fostering the growth of the digital payment market. Governments and regulatory authorities worldwide are recognizing the potential benefits of digital payments, such as reducing the informal economy, enhancing financial inclusion, and combating fraud. As a result, policies and regulations are being crafted to promote the adoption of digital payment technologies while ensuring consumer protection and data security. Regulatory initiatives often focus on interoperability standards, data privacy laws, and promoting competition among payment service providers, which collectively create a conducive environment for the expansion of digital payment solutions.

Digital Payment Market Report Segmentation:

By Component:

Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Transaction Risk Management

- Others

Services

- Professional Services

- Managed Services

Solutions represent the largest segment by component due to comprehensive functionalities and integrative capabilities.

By Payment Mode:

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

Digital wallets dominate the market owing to their convenience and widespread smartphone adoption.

By Deployment Type:

- Cloud-based

- On-premises

On-premises account for the largest market share due to data security concerns and regulatory compliance.

By End Use Industry:

- BFSI

- Healthcare

- IT and Telecom

- Media and Entertainment

- Retail and E-commerce

- Transportation

- Others

BFSI sectors represent the biggest end-use industry because of stringent security requirements and financial transaction volumes.

Regional Insights:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

North America leads the market due to its advanced technological infrastructure and high consumer acceptance of digital payment methods.

Competitive Landscape with Key Players:

The competitive landscape of the digital payment market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

- ACI Worldwide Inc.

- Adyen N.V.

- Aliant Payment Systems Inc.

- com Inc.

- American Express Company

- Apple Inc.

- Fiserv Inc.

- Mastercard Incorporated

- Novetti Group Limited

- Paypal Holdings Inc.

- Stripe Inc.

- Total System Services Inc.

- Visa Inc.

- Wirecard AG

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2473&flag=C

Key Highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- Market Trends

- Market Drivers and Success Factors

- Impact of COVID-19

- Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

Americas: +1-631-791-1145