In recent times, the monetary landscape has seen a significant shift in direction of different investment options, significantly in the realm of retirement planning. One of the notable traits is the rising recognition of Particular person Retirement Accounts (IRAs) that enable for the inclusion of gold and other precious metals. This case examine explores the advantages, dangers, and general impression of IRA gold accounts on retirement planning.

Understanding IRA Gold Accounts

An IRA gold account is a type of self-directed IRA that permits buyers to carry physical gold, silver, platinum, and palladium as a part of their retirement portfolio. In contrast to conventional IRAs, which primarily put money into stocks, bonds, and mutual funds, gold IRAs provide a hedge in opposition to inflation and financial uncertainty. They allow buyers to diversify their retirement savings and protect their wealth from market volatility.

The Historical Context

The concept of investing in gold as a means of preserving wealth dates again thousands of years. Nevertheless, it wasn't until the Taxpayer Relief Act of 1997 that the inclusion of valuable metals in IRAs turned authorized. This laws opened the door for investors to incorporate tangible belongings into their retirement accounts, resulting in a rising curiosity in gold IRAs.

Advantages of IRA Gold Accounts

- Inflation Hedge: Gold has traditionally been viewed as a safe haven throughout durations of inflation. As the value of fiat currencies decreases, gold tends to maintain its purchasing power, making it a sexy option for retirement savings.

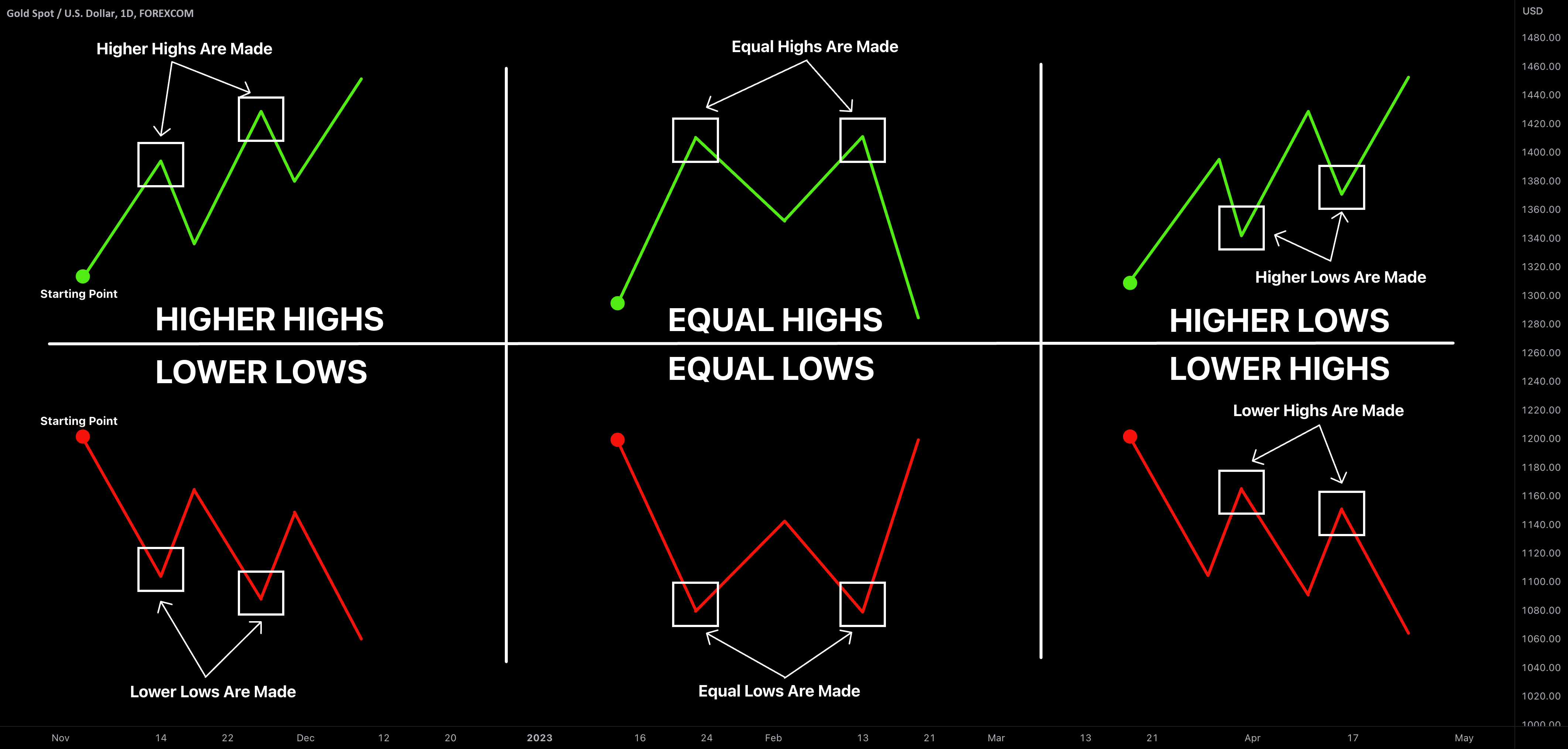

- Diversification: Including gold in an funding portfolio can present diversification advantages. Gold typically has a low correlation with traditional asset courses, such as stocks and bonds, which may also help scale back overall portfolio threat.

- Tangible Asset: Not like stocks or bonds, gold is a physical asset that buyers can hold. If you loved this write-up and you would like to acquire far more facts pertaining to callarihomesltd.com kindly go to our own site. This tangibility can present a sense of security, particularly throughout occasions of economic instability.

- Tax Benefits: Just like conventional IRAs, gold IRAs offer tax-deferred progress. Traders do not pay taxes on the features from their gold investments till they withdraw funds throughout retirement, potentially permitting for vital development over time.

- Safety from Financial Instability: In occasions of geopolitical turmoil or monetary crises, gold often retains its value better than other investments. This characteristic makes gold IRAs an appealing possibility for risk-averse traders.

Dangers and Concerns

Whereas IRA gold accounts supply quite a few advantages, they also include risks and considerations that investors must remember of:

- Market Volatility: The price of gold will be volatile, influenced by numerous components corresponding to global financial situations, curiosity charges, and forex fluctuations. Traders should be prepared for potential worth swings.

- Storage and Insurance Costs: Physical gold have to be saved securely, which regularly includes further costs for storage and insurance. Investors need to consider these expenses when contemplating gold IRAs.

- Limited Funding Options: Gold IRAs usually enable for a restricted range of investments compared to conventional IRAs. This limitation might not suit all traders, significantly these searching for a broader array of investment in gold-backed iras usa opportunities.

- Regulatory Compliance: Investors should be sure that their gold investments comply with IRS laws. Solely certain forms of gold and valuable metals are permitted in IRAs, and failing to adhere to those laws can lead to penalties.

- Liquidity Issues: Promoting physical gold may be less straightforward than liquidating traditional investments. Traders could face challenges find buyers or might incur extra fees when selling their gold holdings.

The Means of Establishing an IRA Gold Account

Setting up an IRA gold account involves a number of steps:

- Select a Custodian: Investors should choose a custodian that focuses on self-directed IRAs and is authorized to hold physical precious metals. The custodian will manage the account and ensure compliance with IRS rules.

- Fund the Account: Investors can fund their gold IRA via varied strategies, together with rolling over funds from an present retirement account or making a direct contribution.

- Select Precious Metals: As soon as the account is funded, traders can choose the specific gold or valuable metals they want to purchase. It's important to pick IRS-accredited coins or bullion to make sure compliance.

- Storage Arrangements: The chosen custodian will usually arrange for secure storage of the physical gold in an authorized depository. Buyers should evaluate the storage choices and related charges.

- Ongoing Administration: Investors can monitor their gold IRA, make extra contributions, and modify their holdings as wanted, all while benefiting from the tax advantages of the account.

Case Study: Success Stories and Classes Discovered

For instance the effectiveness of IRA gold accounts, consider the case of an investor, John, who began exploring retirement choices in 2010. Concerned concerning the potential for financial downturns and inflation, John decided to allocate a portion of his retirement savings right into a gold IRA.

John labored with a good custodian to set up his account and bought a mix of gold coins and bullion. Over the following decade, he witnessed vital fluctuations in the inventory market, but his gold investments remained relatively stable. By 2020, when the COVID-19 pandemic led to unprecedented economic uncertainty, John's gold holdings had appreciated in value, providing a a lot-needed security web during a tumultuous time.

This case demonstrates the potential benefits of gold IRAs, notably as a hedge towards economic instability. However, it additionally underscores the significance of conducting thorough analysis and dealing with knowledgeable professionals to navigate the complexities of precious metal investments.

Conclusion

IRA gold accounts signify a compelling choice for investors searching for to diversify their retirement portfolios and protect their wealth from market volatility. While they offer numerous benefits, together with inflation hedging and tangible asset safety, investors should also be conscious of the associated dangers and prices. Because the monetary landscape continues to evolve, gold IRAs might play an more and more important function in retirement planning, providing a safe and stable funding avenue for those seeking to safeguard their monetary future.