Lately, the demand for gold as an investment has surged, particularly in the type of a Gold Particular person Retirement Account (IRA). Gold IRAs allow investors to carry physical gold and other reliable precious metals investment ira metals in their retirement accounts, providing a hedge against inflation and financial uncertainty. Nevertheless, choosing the proper Gold IRA company is essential for making certain a clean and safe investment expertise. This report goals to judge and identify the best options for ira in precious metals Gold IRA companies in the market primarily based on varied factors, including reputation, charges, customer service, and investment options.

Understanding Gold IRAs

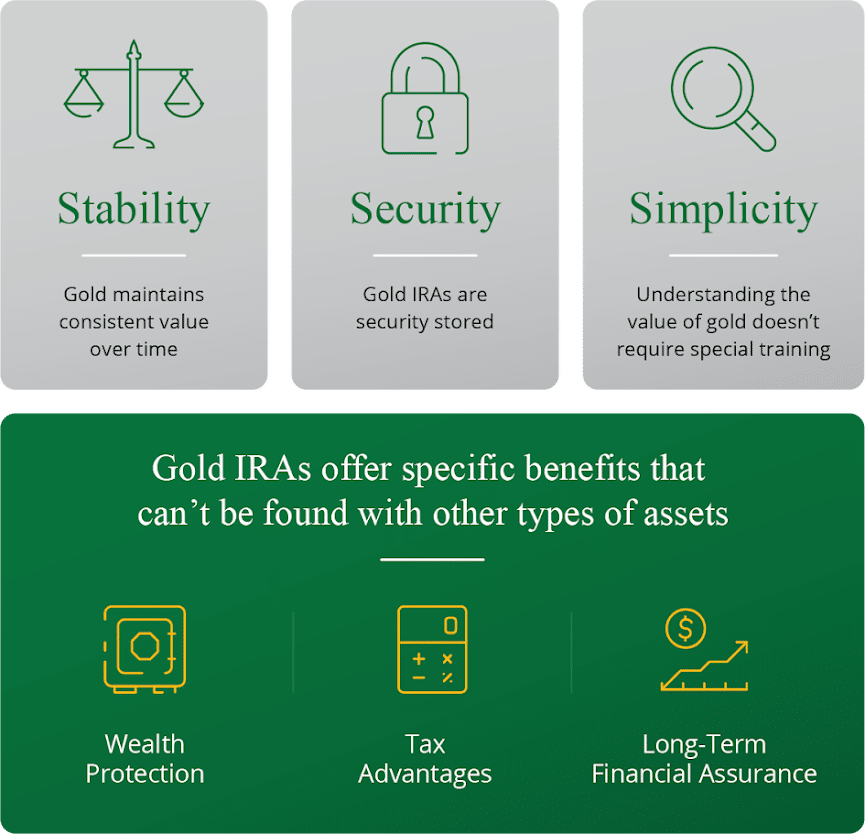

A Gold IRA is a type of self-directed IRA that permits traders to include physical gold, silver, platinum, and palladium in their retirement portfolios. In contrast to traditional IRAs that sometimes hold stocks, bonds, and mutual funds, Gold IRAs supply a unique solution to diversify investments and protect towards market volatility. The IRS has particular rules relating to the sorts of metals that can be included in a Gold IRA, which is why selecting a reputable company is essential.

Key Components to consider When Choosing a Gold IRA Company

- Status and Trustworthiness: Step one in evaluating a Gold IRA company is to assess its status in the business. Look for companies with a strong monitor file, positive buyer evaluations, and industry recognition. Checking with organizations equivalent to the better Business Bureau (BBB) can present insights into an organization's reliability.

- Charges and Costs: Understanding the fees associated with a Gold IRA is crucial. Companies may charge setup fees, storage fees, and transaction charges. It is crucial to compare these costs amongst completely different providers to ensure you're getting a good deal.

- Customer support: Quality customer service could make a significant distinction in your funding experience. A very good Gold IRA company should offer clear communication, educated workers, and support throughout the investment course of.

- Investment Choices: Totally different firms could offer numerous kinds of valuable metals for funding. It is important to choose a company that provides a wide range of choices, allowing for diversification inside your Gold IRA.

- Storage Options: Gold IRAs require safe storage options for the bodily metals. Firms may provide different storage choices, together with segregated and non-segregated storage. Understanding these options and their associated prices is important.

Top Gold IRA Companies

Based on the standards outlined above, we have now identified a number of main Gold IRA companies that stand out in the trade.

1. Birch Gold Group

Birch Gold Group has established itself as a prominent player in the Gold IRA market. With over 15 years of experience, the corporate is understood for its dedication to educating investors about valuable metals. Birch Gold Group gives a spread of investment choices, together with gold, silver, platinum, and palladium. They supply wonderful customer support, with devoted representatives to assist clients throughout the investment course of. The company's clear fee construction and secure options for investing in precious metals iras storage choices make it a top choice for traders.

2. Noble Gold Investments

Noble Gold Investments is another respected firm that focuses on Gold IRAs. With a deal with customer education, Noble Gold provides a wealth of sources to assist buyers make informed decisions. They supply a wide range of funding choices, together with rare coins, which may enhance the worth of a Gold IRA. Noble Gold is thought for its low charges and distinctive customer service, ensuring a positive expertise for traders.

3. Goldco

Goldco is a effectively-established firm that has garnered a powerful status in the Gold IRA house. They provide a wide range of treasured metals for investment and have a person-pleasant on-line platform for managing accounts. Goldco is understood for its competitive pricing and transparent payment structure. Moreover, the corporate provides glorious customer support, with educated representatives out there to help purchasers. Goldco also offers a buyback program, permitting traders to promote their metals back to the company at a good worth.

4. American Hartford Gold

American Hartford Gold is a newer entrant within the Gold IRA market however has quickly gained recognition for its commitment to customer service and training. The corporate offers a variety of precious metals for funding and provides a easy, simple process for setting up a Gold IRA. American Hartford Gold is thought for its low charges and clear pricing, making it a sexy possibility for traders seeking to diversify their retirement portfolios.

5. Regal Assets

Regal Property has positioned itself as a frontrunner in the Gold IRA industry, providing a wide range of funding choices, including cryptocurrencies. The company is known for its innovative strategy to valuable metals investing and provides a consumer-pleasant online platform for account management. If you loved this information and you would like to obtain additional information regarding affordable gold ira providers kindly go to the website. Regal Belongings gives aggressive pricing and a clear price structure. Their commitment to customer support and satisfaction has earned them a loyal shopper base.

Conclusion

Investing in a Gold IRA could be a smart technique for diversifying retirement portfolios and defending towards financial uncertainty. Nonetheless, choosing the proper Gold IRA company is critical to guaranteeing a successful investment experience. Primarily based on our evaluation, Birch Gold Group, Noble Gold Investments, Goldco, American Hartford Gold, and Regal Belongings are among the many best Gold IRA companies obtainable at the moment. These companies stand out for their status, customer service, transparent fees, and vary of funding options. As at all times, potential traders should conduct their own research and consider their particular person financial objectives before making any funding decisions.