Global Shrimp Market Size and Share Analysis – Growth Trends and Forecast Report 2025–2033

Market Summary

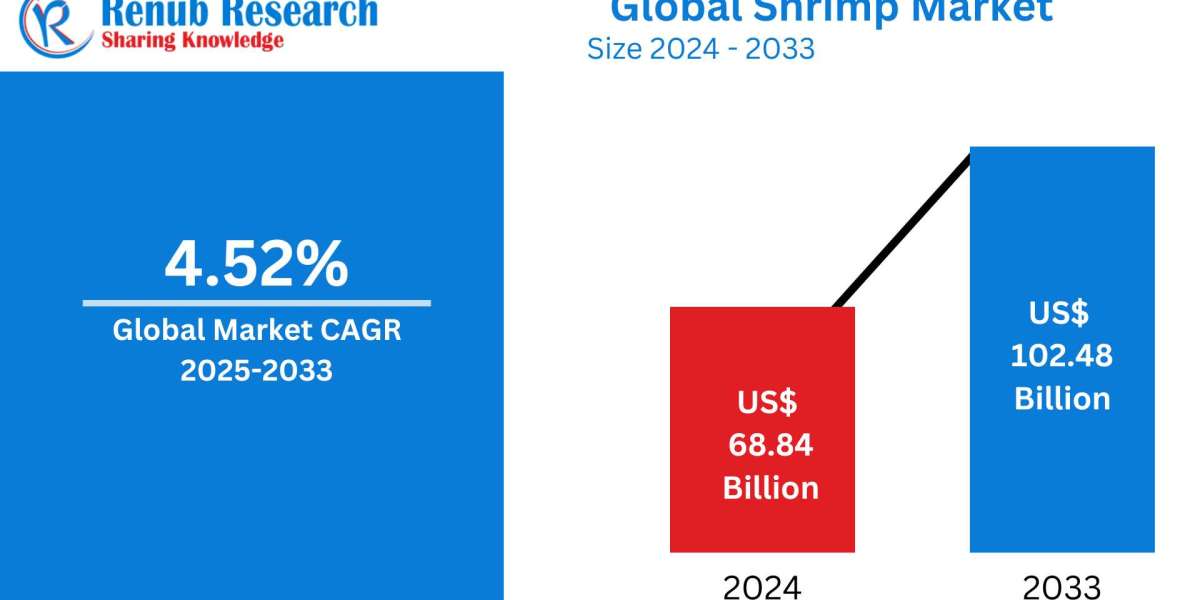

The Global Shrimp Market was valued at USD 68.84 Billion in 2024 and is projected to reach USD 102.48 Billion by 2033, expanding at a CAGR of 4.52% during 2025–2033. This growth is underpinned by rising seafood consumption, expanding health consciousness among consumers, and increasing technological innovations in shrimp aquaculture. Additionally, the growing demand for processed, convenient, and premium shrimp products is further propelling global market dynamics.

? Global Shrimp Market Outlook

Shrimp, a widely consumed crustacean, plays a critical role in global dietary patterns due to its rich protein content, low fat, and abundance of essential nutrients like omega-3 fatty acids, iodine, vitamin B12, and astaxanthin antioxidants. These health benefits—especially in supporting cardiovascular health, metabolism, immune function, and anti-aging—continue to make shrimp a dietary staple in both developing and developed nations.

From traditional dishes to modern ready-to-eat meals, shrimp's versatility across cuisines and preparation methods—grilled, steamed, fried, or in soups and salads—adds to its mass appeal.

? Key Market Drivers

- Rising Demand for Protein-Rich and Lean Seafood

As consumers globally shift towards healthier diets, shrimp is emerging as a top-tier lean protein alternative to red meat. This is strongly influenced by growing pescatarian and flexitarian dietary trends. Furthermore, fitness-conscious consumers are actively seeking low-calorie, high-protein food options, making shrimp a go-to seafood item.

Notable Development:

- June 2023: Skretting, a Norwegian aquafeed firm, introduced Elevia, a high-performance shrimp feed aimed at hatchery nutrition, improving larval health and water quality.

- Expansion and Innovation in Shrimp Aquaculture

Countries like India, Vietnam, Ecuador, and Indonesia are heavily investing in aquaculture expansion using technologies like biofloc systems, RAS, and disease-resistant broodstock, making shrimp farming more sustainable and cost-efficient.

Notable Development:

- Dec 2024: Ace Aquatec launched the world’s first humane stunning system for shrimp, applied in Thailand with support from the Shrimp Welfare Project.

- Demand for Processed & Value-Added Shrimp

Modern consumers seek convenience. As a result, demand for frozen, breaded, pre-cooked, and microwaveable shrimp products is growing rapidly in regions like the United States, Europe, and Japan.

Notable Development:

- Feb 2025: Labeyrie Fine Foods invested €18 million in France to double its cooked shrimp production capacity to 18,000 metric tons annually.

⚠️ Challenges in the Shrimp Market

- Environmental and Sustainability Concerns

Shrimp farming often faces criticism over mangrove destruction, antibiotic overuse, and pollution. This has increased the push for certified and eco-friendly practices, guided by labels like ASC (Aquaculture Stewardship Council) and MSC (Marine Stewardship Council).

- Trade Disruptions and Regulatory Barriers

Being export-oriented, the shrimp industry is sensitive to trade policies, geopolitical conflicts, and supply chain disruptions (e.g., climate change or pandemics). Major markets like the US and EU maintain strict import regulations and food safety standards.

Related Reports

- Mexico Shrimp Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- Malaysia Shrimp Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- Japan Shrimp Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- Italy Shrimp Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- India Shrimp Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- Germany Shrimp Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- France Shrimp Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- China Shrimp Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

? Market by Species

- L. vannamei (Whiteleg Shrimp)

The most farmed and traded shrimp species globally, L. vannamei is favored for its resilience, fast growth, and cost-effective farming, particularly across Asia and Latin America.

Highlight:

- Oct 2022: Kazakhstan launched its first shrimp farm near Almaty focusing on L. vannamei.

- P. monodon (Black Tiger Shrimp)

Known for its large size and rich flavor, this species is highly prized in luxury seafood markets and commands premium prices. Key producers include India, Vietnam, and Bangladesh.

- M. rosenbergii (Giant Freshwater Prawn)

This species is gaining popularity for its sweet taste, large claws, and suitability for both freshwater and brackish environments.

? Market by Size Category

15–20 Size Shrimp

Preferred by high-end restaurants and gourmet markets for grilling and luxury dishes. This segment sees strong demand in hotels, banquets, and specialty seafood stores.

31–40 Size Shrimp

The most commercially viable and universal size, ideal for breaded, frozen, and quick-service restaurant applications.

? Market by Product Form

Breaded Shrimp

High consumer demand for ready-to-cook meals is boosting this segment, especially across supermarkets and fast-food chains.

Cooked Shrimp

Appeals to time-conscious customers seeking convenience. Cooked shrimp is widely sold in retail packs, meal kits, and catering menus.

Green/Head-On Shrimp

Often targeted at gourmet, Asian, and European markets where freshness and whole shrimp presentation are preferred.

? Country-Wise Insights

United States

The U.S. is one of the largest shrimp importers. Rising demand for processed shrimp like breaded and cooked variants boosts imports from India, Ecuador, and Vietnam.

Highlight:

- Apr 2023: CP Foods launched Homegrown Shrimp USA, a Florida-based sustainable shrimp farm.

Italy

Italy’s Mediterranean cuisine ensures consistent demand for fresh and wild-caught shrimp, especially in premium categories like Black Tiger shrimp.

Highlight:

- Mar 2022: Lisaqua raised €4.9 million to establish France's first land-based shrimp farm, emphasizing sustainable production.

China

China remains the world’s top producer and consumer of shrimp. However, its domestic production faces issues related to disease, feed cost, and climate risks, prompting exploration into land-based and integrated aquaculture models.

? Shrimp Farming Industry – The Backbone of Supply

The shrimp aquaculture industry is evolving rapidly, driven by:

- Technological advancements (e.g., IoT for water quality monitoring, automated feeding systems).

- Government support, particularly in Asia.

- Sustainability mandates from importers and consumers.

Highlight:

- India: ICAR-CIBA’s super-intensive shrimp farming initiative is expected to tackle challenges like disease outbreaks, climate risk, and production costs.

- Union Budget 2025: India raised Kisan Credit Card limit to INR 5 lakh to financially empower shrimp farmers and promote innovation.

? Forecast and Future Trends

- Tech-driven shrimp farming (e.g., AI-driven feeding, blockchain traceability).

- Increased investment in R&D, particularly in disease prevention and water recycling systems.

- E-commerce expansion will bring more ready-to-eat and gourmet shrimp products to digital platforms.

- Rising focus on shrimp welfare, ethical sourcing, and carbon-neutral aquaculture.

? 10 Key Questions Answered in the Report

- What is the projected size of the global shrimp market by 2033?

- Which factors are driving the demand for processed and ready-to-cook shrimp?

- How is technology shaping the future of shrimp aquaculture?

- Which countries dominate global shrimp production?

- What are the most traded shrimp species worldwide?

- How are environmental concerns influencing aquaculture practices?

- Which size categories of shrimp are most in demand across retail and HoReCa channels?

- How is the value-added shrimp market evolving in the U.S. and Europe?

- What regulatory or trade challenges face shrimp exporters?

- How are sustainability certifications impacting shrimp sourcing and marketing?