Saudi Arabia Hotel Market Size and Share Analysis: Growth Trends & Forecast Report 2025–2033

Market Overview

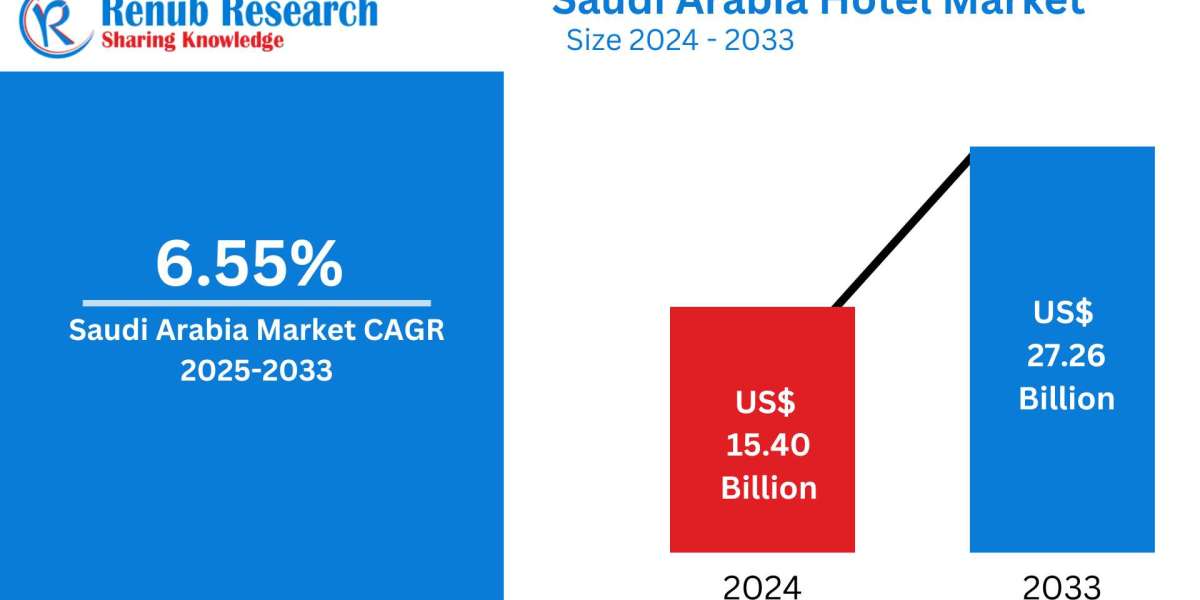

The Saudi Arabia hotel market is poised for remarkable expansion, projected to grow from US$ 15.40 Billion in 2024 to US$ 27.26 Billion by 2033, registering a CAGR of 6.55% during 2025–2033. This robust growth is driven by Vision 2030 tourism strategies, surging pilgrimage demand, hospitality mega-projects, and liberalized visa policies.

The report offers detailed segmentation by hotel category (high-end, mid-scale, budget), booking channels (online and offline), and regions (Riyadh, Jeddah, Makkah, Madinah, Dammam, Al Khobar). It also includes a competitive landscape and performance benchmarking of major hospitality players operating in the Kingdom.

Saudi Arabia Hotel Industry Dynamics

Strategic National Vision & Government Support

Saudi Arabia's hospitality landscape is undergoing a transformational shift under Vision 2030, aiming to position the Kingdom as a global tourism hotspot. Key drivers include:

- Investment of over US$ 550 Billion into tourism and entertainment mega-projects like NEOM, Red Sea Project, and Qiddiya.

- Relaxed visa policies including e-visas, visa-on-arrival, and multi-entry tourist visas for 49 countries.

- Infrastructure upgrades in domestic travel (airports, railways, smart cities) to enhance regional connectivity.

Boom in Religious Tourism

Saudi Arabia's religious tourism segment remains the backbone of the hotel market, with Makkah and Madinah witnessing overwhelming demand across star categories. In 2024 alone, 18.5 million pilgrims visited the holy cities for Hajj and Umrah.

- Pilgrim infrastructure expansion projects are fueling hotel construction near Haram boundaries.

- Government aims to achieve 100 million tourist arrivals by 2030, a major chunk of which are spiritual travelers.

- Increasing preference for organized travel, family-friendly stays, and extended religious visits is fueling both high-end and budget accommodation demand.

Domestic & Regional Travel on the Rise

Post-pandemic, domestic travel surged with Saudis exploring AlUla, Abha, Al Bahah, and Red Sea coastal cities. In 2024, domestic tourism recorded:

- 44% increase in bookings across the country.

- 35% of stays in 3-star or lower hotels, showing value-based demand.

- 90% growth in family travel and 60% rise in group bookings.

These trends highlight evolving travel preferences and a shift toward diversified accommodation offerings including hotel apartments, resorts, and eco-stays.

Online Booking Revolution

The online booking segment in Saudi Arabia is experiencing accelerated growth, driven by:

- High smartphone penetration (97%) and digital literacy.

- Strong presence of Booking.com, Expedia, Agoda, and regional OTAs like Almosafer.

- Hotels adopting direct booking strategies via apps and websites to reduce dependency on intermediaries.

Online platforms also support dynamic pricing, targeted promotions, and real-time customer engagement, making them indispensable for modern hotel operators.

Key Challenges

Operational Cost Pressures

High operational expenditure remains a bottleneck, especially for luxury hotels. Challenges include:

- Staffing and compliance with Saudization policies.

- High energy consumption, maintenance costs, and investment in modern facilities.

- Limited pool of trained Saudi hospitality professionals, necessitating long-term investment in skill development programs and hospitality academies.

Urban Market Saturation

- Over-concentration of hotels in Riyadh, Jeddah, Makkah, and Madinah risks oversupply and price wars.

- Upscale and mid-scale segments are especially crowded, diluting occupancy rates during off-seasons.

- Hotels need to diversify into secondary cities and niche experiences (e.g., eco-tourism, heritage resorts) to stay competitive.

Related Reports

- India Hotel Market, Size, Forecast 2023-2030, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

- Turkey Hotel Market & Volume, Budget & Star Rated Hotel ( 1st, 2nd, 3rd, 4th, 5th) Star, City, Province, Chain Hotel (International, Domestic), Company (Hilton, Marriott, Radisson, Accor) & Forecast

- Spain Hotel Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- Japan Hotel Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Segmental Analysis

High-End Hotel Segment

This segment is flourishing with demand from luxury pilgrims, diplomats, executives, and tourists seeking premium experiences. Growth is concentrated in:

- Five-star properties in Makkah & Madinah like Raffles, Conrad, and Fairmont.

- Business hubs in Riyadh with brands like Ritz-Carlton, Four Seasons, and Hilton.

- Emerging resort destinations in NEOM and the Red Sea are expected to redefine luxury hospitality in the Middle East.

Mid-Scale Hotel Segment

Mid-range hotels are the backbone for domestic tourism and affordable international stays. Their success is attributed to:

- Brands like Holiday Inn, Novotel, Park Inn gaining traction across tier-2 cities and religious destinations.

- Offering value-for-money services including convenient locations, complimentary amenities, and loyalty programs.

- Increasing alignment with business travel and group tourism expectations.

Online & Offline Booking Channels

- Online bookings dominate among millennial travelers and digital-savvy residents.

- Offline bookings (via travel agents, phone reservations, direct walk-ins) still persist for religious travelers and older demographics.

- Hybrid models with personalized services and online convenience are becoming standard across hotels.

Regional Market Insights

Makkah Hotel Market

- Demand peaks during Hajj & Umrah seasons.

- Significant investments in hospitality infrastructure near Masjid al-Haram.

- Joint ventures like Umm Al-Qura and GAA’s SAR 2.5 Billion investment indicate strategic hospitality development.

Riyadh Hotel Market

- Driven by business travel, corporate events, expos, and government summits.

- Hotels range from international 5-star properties to serviced apartments.

- Vision 2030 initiatives are transforming Riyadh into a premier MICE destination.

Hotel Occupancy & Performance Trends

- Makkah & Madinah: Seasonal peaks during religious events.

- Riyadh & Jeddah: Consistent occupancy due to business and domestic travel.

- Occupancy rates are key indicators of hotel health and guide expansion strategies and investment decisions.

- Major upcoming events like the 2030 World Expo bid and international sporting events will further boost performance metrics.

Competitive Landscape

Major Players

- Dur Group

- IHG Group

- Marriott International

- Accor

- Hilton Hotels

- Al Hokair Group

- Al Tayyar Group

These companies are actively expanding via franchise models, management contracts, and local partnerships to gain market share.

Recent Developments

- Marriott International launched its 31st brand, City Express by Marriott, following its acquisition of Hoteles City Express.

- Taiba Investments made a strategic acquisition deal via share exchange, strengthening its hotel portfolio in Saudi Arabia.

Conclusion: Outlook and Future Opportunities

The Saudi Arabia hotel market stands at a strategic inflection point, blending religious, cultural, and leisure tourism under Vision 2030. With massive infrastructure development, global brand participation, and surging demand from multiple traveler segments, the Kingdom is evolving into a world-class tourism hub. Future success will depend on:

- Strategic capacity planning.

- Embracing digital transformation.

- Workforce training and localization.

- Targeted marketing for diversified tourism.