In the dynamic world of industrial polymers, polybutadiene stands as one of the most widely utilized synthetic rubbers due to its unique chemical and mechanical properties. From automobile tires to electronics, golf balls to industrial belts, polybutadiene plays a pivotal role across a multitude of applications. This demand is driven by its exceptional resilience, low glass transition temperature, and outstanding abrasion resistance. As industries continue to expand and adapt to changing technological landscapes, the use of synthetic rubbers like polybutadiene becomes increasingly indispensable. The global polybutadiene market stood at a value of USD 7.61 billion in 2024 and is expected to grow at a CAGR of 4.20% during the forecast period of 2025–2034, reaching USD 11.48 billion by 2034. This projected growth underlines the growing importance of polybutadiene in various end-user industries, including automotive, plastics, and construction.

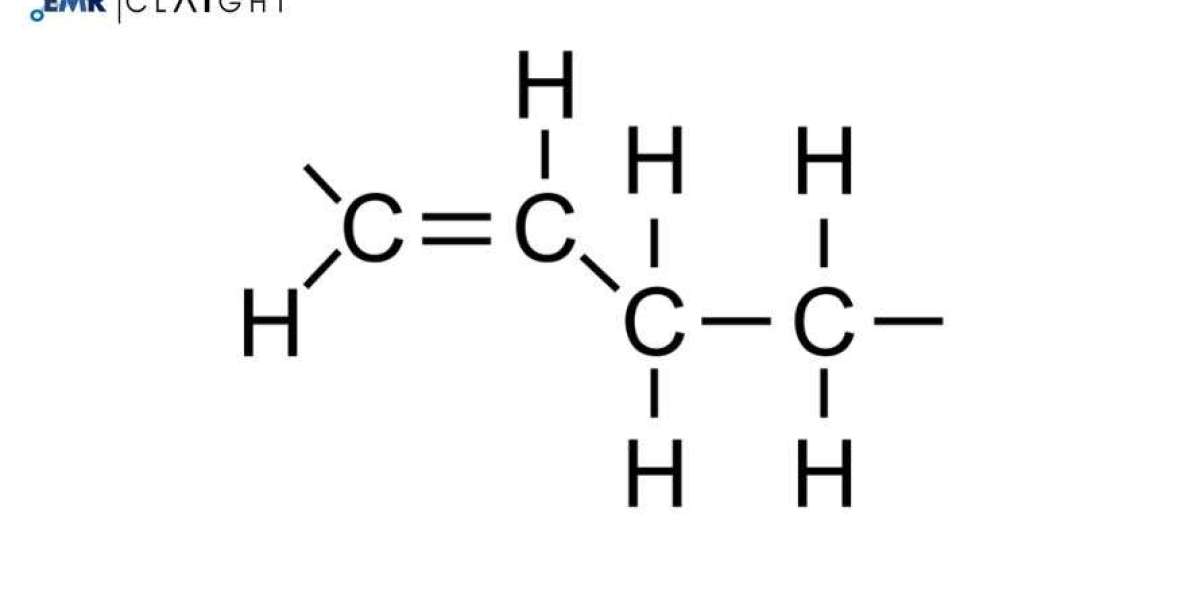

Understanding Polybutadiene: Structure and Properties

Polybutadiene is a synthetic rubber primarily derived through the polymerization of 1,3-butadiene. It comes in different forms, primarily high-cis polybutadiene, low-cis, and high vinyl polybutadiene, each characterized by different molecular structures and uses. Its most recognized features include:

High elasticity

Excellent abrasion and wear resistance

Good low-temperature performance

Resistance to cracking and stress

Due to these properties, polybutadiene is often used as an impact modifier or a blending agent in manufacturing other types of rubber and plastic products.

Key Market Drivers

Booming Automotive Industry

One of the strongest growth drivers for the polybutadiene market is the global automotive sector. Approximately 70% of the world’s polybutadiene is used in the production of tires, especially in the sidewalls and treads. Its high resilience and resistance to wear make it ideal for this purpose. With the rising number of vehicle sales—particularly in emerging economies like India, Brazil, and China—the demand for durable and fuel-efficient tires is surging, which directly boosts polybutadiene consumption.

Growing Use in Polymer Modification

Polybutadiene is a key component in manufacturing high-impact polystyrene (HIPS) and acrylonitrile butadiene styrene (ABS). These polymers are widely used in electronics, automotive parts, household appliances, and toys. With increasing consumer demand for durable and lightweight plastic materials, the market for HIPS and ABS is growing steadily, thereby fueling polybutadiene demand.

Rising Demand in Sports and Consumer Goods

The elasticity and energy transfer properties of polybutadiene make it ideal for sporting goods such as golf balls and various footwear components. Additionally, it's used in conveyor belts, industrial hoses, and mechanical rubber goods. The expanding fitness and leisure industry worldwide further increases its application in sporting goods and related accessories.

Industrial Applications and Infrastructure Growth

Polybutadiene is also used in sealants, adhesives, and coatings, especially in the construction and mining industries. As infrastructure development increases globally, especially in Asia-Pacific and the Middle East, polybutadiene demand in construction-related applications is anticipated to grow steadily.

Market Segmentation

By Product Type

High Cis Polybutadiene – Widely used in tire manufacturing due to superior abrasion resistance and strength.

Low Cis Polybutadiene – Typically used in applications that require more flexibility but less structural strength.

High Vinyl Polybutadiene – Often used in high-impact polystyrene applications due to its higher glass transition temperature.

By Application

Tires

Polymer Modification (HIPS, ABS)

Industrial Rubber

Footwear

Golf Balls

Adhesives & Sealants

By End-Use Industry

Automotive

Construction

Consumer Goods

Chemical Manufacturing

Electrical & Electronics

Regional Market Analysis

Asia-Pacific: The Leading Region

Asia-Pacific dominates the global polybutadiene market, both in production and consumption. The rapid expansion of automotive and manufacturing industries in countries such as China, India, South Korea, and Japan is a major factor. China's tire manufacturing industry, in particular, is a significant consumer of polybutadiene.

Moreover, government initiatives toward infrastructure development and industrialization are further boosting market demand. The presence of low-cost labor and raw materials also supports competitive production in this region.

North America: Stable Growth

North America has a mature synthetic rubber industry, and its polybutadiene market is expected to grow at a steady pace. The United States is the major player in this region, with well-established automotive and consumer goods industries. Increased focus on renewable and fuel-efficient tires is also expected to create new growth avenues for synthetic rubber products.

Europe: Innovation-Driven Market

Europe focuses on technological innovation and sustainability, leading to advanced applications of polybutadiene in eco-friendly tire manufacturing and automotive components. Germany, France, and Italy are leading countries in both production and consumption.

Middle East & Africa and Latin America: Emerging Markets

These regions are witnessing increasing demand for synthetic rubber due to growing industrial activity, construction development, and automotive imports. Though still nascent, they represent significant untapped potential for polybutadiene manufacturers.

Technological Advancements in the Polybutadiene Industry

Green Manufacturing and Bio-Based Alternatives

Environmental concerns are pushing the industry to explore sustainable alternatives. Research is being conducted to develop bio-based polybutadiene using renewable feedstocks. Innovations like neodymium-based catalysis have improved polymerization control, resulting in better product consistency and performance.

Recycling and Waste Reduction

The industry is making efforts to integrate closed-loop recycling systems and reuse rubber materials, especially from used tires. This not only reduces environmental impact but also supports cost-effective production.

Smart Materials and Advanced Blends

With rising demand for specialized applications in electronics and aerospace, manufacturers are creating custom polybutadiene blends with advanced thermal, acoustic, and electrical properties. Smart polymers that respond to environmental changes are becoming a research hotspot.

Challenges in the Polybutadiene Market

Volatile Raw Material Prices

Butadiene, the key raw material for polybutadiene, is derived from crude oil. Fluctuations in oil prices directly affect production costs. In times of high crude prices, profit margins for producers can shrink significantly.

Environmental Concerns and Regulation

While polybutadiene is valuable industrially, its production and disposal raise concerns regarding VOC emissions and non-biodegradability. Regulatory frameworks such as REACH in Europe and EPA regulations in the U.S. are placing pressure on manufacturers to adopt cleaner processes.

Competition from Alternatives

Natural rubber and other synthetic rubbers (such as SBR and NBR) sometimes offer more cost-effective or environmentally friendly alternatives in certain applications, posing a competitive challenge to polybutadiene.

Competitive Landscape

The global polybutadiene market is moderately consolidated, with several key players competing in terms of product quality, innovation, price, and sustainability. Notable companies include:

SABIC

Kumho Petrochemical

Lanxess AG

LG Chem

JSR Corporation

Reliance Industries

Evonik Industries

ENI S.p.A. (Versalis)

These companies are actively expanding their production capacities, engaging in joint ventures, and investing in R&D to stay ahead in the competitive landscape.

Strategic Developments and M&A Activities

Several companies are entering strategic partnerships or acquiring smaller firms to expand their geographic reach and strengthen their product portfolios. For instance:

Kumho Petrochemical has been focusing on capacity expansion in Asia.

Lanxess has invested in green chemistry R&D to reduce its environmental footprint.

JSR Corporation has explored advanced polybutadiene applications for electronics and specialty polymers.

Such strategic moves are shaping the competitive dynamics of the industry and promoting technological advancements.

Future Outlook and Opportunities

Demand for Fuel-Efficient Vehicles

As governments enforce stricter fuel economy and emission standards, tire manufacturers are shifting toward low rolling resistance tires, which use high-performance polybutadiene. This trend is expected to drive demand significantly in the coming years.

Expanding Use in Renewable Energy and Electronics

With increasing electrification of vehicles and investments in renewable energy infrastructure, polybutadiene's role as an insulating and impact-resistant material could broaden into emerging sectors.

Focus on Circular Economy

Adopting circular economy practices through recycling, material recovery, and eco-design is expected to shape the next generation of polybutadiene products. These innovations will not only reduce waste but also enhance brand value and compliance with future regulations.

Media Contact

Company Name: Claight Corporation

Contact Person: Chander Deep, Corporate Sales Specialist

Email: sales@expertmarketresearch.com

Toll Free Number: +1–415–325–5166 | +44–702–402–5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: www.expertmarketresearch.com