"North America Digital Twin Financial Services and Insurance Market Size, Share, and Trends Analysis Report—Industry Overview and Forecast to 2030

According to Data Bridge Market Research firms, the NA Digital Twin Insurance Market is set to achieve robust growth, supported by emerging economies and digital transformation. Companies operating in the North America Financial Services Digital Twin Solutions are leveraging advanced technologies to enhance productivity and meet consumer expectations. The demand for customized solutions is rising, further driving expansion in the Digital Twin Technology in Finance NA. Leading industry players are focusing on research-backed strategies to strengthen their market position. As competition intensifies, businesses in the North America Digital Twin for Insurance Industry are utilizing detailed market research reports to understand shifting trends, consumer behavior, and future opportunities in the NA Digital Twin Solutions Financial Market.

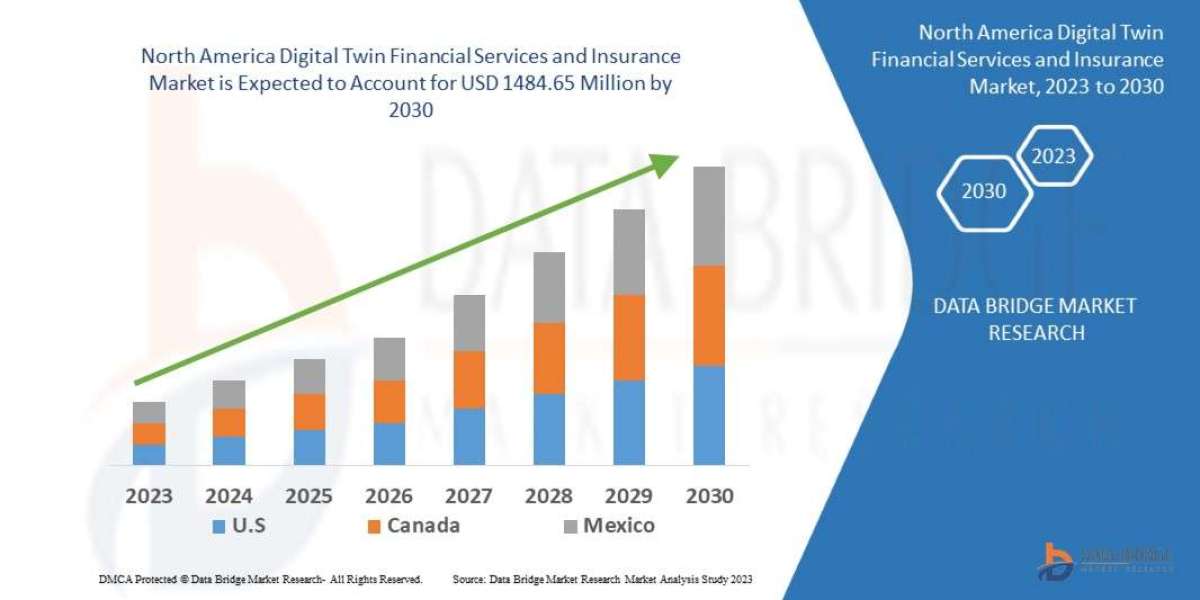

The North America Digital Twin Financial Services and Insurance Market is poised for significant growth, with a market outlook highlighting substantial growth potential driven by emerging opportunities in key sectors. This report provides strategic insights, demand dynamics, and revenue projections, offering a comprehensive view of the future landscape, technology disruptions, and adoption trends shaping the industry’s ecosystem evaluation. According to Data Bridge Market Research Data Bridge Market Research analyses that the digital twin financial services and insurance market is expected to reach USD 1484.65 million by 2030, which is USD 455.99 million in 2022, at a CAGR of 15.90% during the forecast period.

Leading market research reports highlight the growing use of advanced solutions in the Digital Twin Technology in Financial Services North America to improve efficiency and sustainability. Businesses are adapting to regulations, integrating technology, and refining their strategies to stay competitive in the Digital Twin Analytics NA. The rise of digital transformation has reshaped the North America Digital Twin Financial Markets, pushing companies to invest in automation and smarter business models. With demand rising, companies in the NA Insurance Technology Digital Twin are focusing on innovation and customer engagement to stand out. As the industry expands, the Digital Twin Applications Financial Services North America presents endless possibilities for businesses ready to embrace change.

Our comprehensive North America Digital Twin Financial Services and Insurance Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://www.databridgemarketresearch.com/reports/north-america-digital-twin-financial-services-and-insurance-market

**Segments**

The North America Digital Twin Financial Services and Insurance Market can be segmented based on various factors such as type, application, and end-user. In terms of type, the market can be divided into hardware, software, and services. Hardware includes sensors, actuators, and other physical components necessary for creating digital twins. Software segment comprises the digital twin software solutions used for modeling, simulation, and analysis. The services segment includes consulting, maintenance, and support services for implementing and managing digital twin solutions in the financial services and insurance sector.

When considering applications, the market can be categorized into asset management, risk management, process optimization, and customer management. Asset management involves creating digital replicas of physical assets such as buildings, equipment, or infrastructure to monitor performance and maintenance requirements. Risk management utilizes digital twins to simulate various scenarios and assess potential risks to financial assets or insurance portfolios. Process optimization focuses on enhancing operational efficiency by analyzing data and optimizing workflows through digital twins. Customer management involves creating personalized experiences and improving customer interactions based on insights from digital twin models.

In terms of end-users, the market can be segmented into banks, insurance companies, asset management firms, and other financial institutions. Banks use digital twins to optimize branch operations, improve customer service, and enhance cybersecurity measures. Insurance companies leverage digital twins for risk assessment, claims processing, and personalized policy offerings. Asset management firms utilize digital twins for portfolio analysis, asset tracking, and predictive maintenance of investments. Other financial institutions adopt digital twins for various purposes such as fraud detection, compliance monitoring, and enhancing customer engagement.

**Market Players**

- Siemens AG

- General Electric

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- PTC Inc.

- Ansys Inc.

- Dassault Systèmes

- Bentley Systems

- Infosys Limited

The North America Digital Twin Financial Services and Insurance Market is witnessing significant growth due to several key factors. One of the primary growth drivers is the increasing adoption of digital transformation strategies by financial institutions and insurance companies. The need to enhance operational efficiency, improve customer experiences, and mitigate risks is prompting organizations to invest in digital twin technologies. Additionally, the growing focus on data analytics, IoT integration, and artificial intelligence is driving the demand for advanced digital twin solutions in the financial services and insurance sector.

Moreover, the rise of InsurTech and FinTech startups is fueling innovation and competition in the market, leading to the development of more sophisticated digital twin applications tailored to the specific needs of the industry. The emergence of Industry 4.0 trends such as smart manufacturing, connected devices, and autonomous systems is also contributing to the expansion of the digital twin market in North America. These technological advancements enable real-time monitoring, predictive analytics, and proactive decision-making, ultimately driving the adoption of digital twin solutions in the financial services and insurance sector.

However, the market faces challenges such as data privacy concerns, cybersecurity risks, and interoperability issues when integrating digital twin platforms with existing IT infrastructure. Ensuring the security and integrity of sensitive financial data and complying with regulatory requirements pose significant challenges for market players. Additionally, the complexity of implementing and managing digital twin solutions, the high upfront costs associated with hardware and software investments, and the shortage of skilled professionals proficient in digital twin technologies are hindering the market growth to some extent.

In conclusion, the North America Digital Twin Financial Services and Insurance Market presents lucrative opportunities for market players to innovate, collaborate, and capitalize on the growing demand for digital transformation solutions in the financial sector. By addressing the challenges and leveraging the latest technologies, companies can stay competitive and drive sustainable growth in this dynamic market landscape.

https://www.databridgemarketresearch.com/reports/north-america-digital-twin-financial-services-and-insurance-market

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies in North America Digital Twin Financial Services and Insurance Market : https://www.databridgemarketresearch.com/reports/north-america-digital-twin-financial-services-and-insurance-market/companies

Key Questions Answered by the Global North America Digital Twin Financial Services and Insurance Market Report:

- How will the increasing adoption of North America Digital Twin Financial Services and Insurance Market in high-performance computing impact the overall market growth?

- How much is the global North America Digital Twin Financial Services and Insurance Market worth? What was the market value in 2024?

- Who are the major players operating in the North America Digital Twin Financial Services and Insurance Market? Which companies are the front runners?

- Which recent industry trends can be implemented to generate additional revenue streams?

- How will AI, IoT, and 5G advancements influence the North America Digital Twin Financial Services and Insurance Market in the next five years?

- What are the key drivers fueling the growth of the North America Digital Twin Financial Services and Insurance Market?

- What are the major challenges and barriers faced by the North America Digital Twin Financial Services and Insurance Market?

- How is technological innovation shaping the future of North America Digital Twin Financial Services and Insurance Market products?

- What is the impact of government regulations and policies on the North America Digital Twin Financial Services and Insurance Market?

- How do supply chain disruptions affect the North America Digital Twin Financial Services and Insurance Market?

- What are the regional differences in demand for North America Digital Twin Financial Services and Insurance Market products?

- How do revenue streams vary across different sectors of the North America Digital Twin Financial Services and Insurance Market?

- What role does technology play in enhancing growth and efficiency in the North America Digital Twin Financial Services and Insurance Market?

Browse More Reports:

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-conversational-computing-platform-market

https://www.databridgemarketresearch.com/reports/global-epigallocatechin-gallate-market

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-aesthetic-and-cosmetic-surgery-devices-market

https://www.databridgemarketresearch.com/reports/global-airway-management-tubes-market

https://www.databridgemarketresearch.com/reports/global-sheet-face-masks-market

Data Bridge Market Research:

☎ Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 984

✉ Email: corporatesales@databridgemarketresearch.com

Tag

North America Digital Twin Financial Services and Insurance Market Size, North America Digital Twin Financial Services and Insurance Market Share, North America Digital Twin Financial Services and Insurance Market Trend, North America Digital Twin Financial Services and Insurance Market Analysis, North America Digital Twin Financial Services and Insurance Market Report, North America Digital Twin Financial Services and Insurance Market Growth, Latest Developments in North America Digital Twin Financial Services and Insurance Market, North America Digital Twin Financial Services and Insurance Market Industry Analysis, North America Digital Twin Financial Services and Insurance Market Key Players, North America Digital Twin Financial Services and Insurance Market Demand Analysis"