The Algorithm Trading Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2028. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-algorithm-trading-market

Which are the top companies operating in the Algorithm Trading Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global Algorithm Trading Market report provides the information of the Top Companies in Algorithm Trading Market in the market their business strategy, financial situation etc.

Thomson Reuters, 63 moons technologies limited, VIRTU Financial Inc., Software AG, MetaQuotes Ltd, Symphony Limited, InfoReach, Inc., Argo Software Engineering, Kuberre Systems, Inc., Tata Consultancy Services Limited, QuantCore Capital Management, LLC, iRageCapital, Automated Trading Softtech Pvt. Ltd., Trading Technologies International, Inc, uTrade., Vela Labs, Inc., AlgoTrader

Report Scope and Market Segmentation

Which are the driving factors of the Algorithm Trading Market?

The driving factors of the Algorithm Trading Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

Algorithm Trading Market - Competitive and Segmentation Analysis:

**Segments**

- **By Component**: The algorithm trading market can be segmented by component into software and services. Software plays a crucial role in algorithmic trading by providing the necessary platforms and tools for executing high-speed trades. Services include consulting, support, and maintenance services essential for the smooth functioning of algorithmic trading systems.

- **By Deployment**: Based on deployment, the market is categorized into cloud-based and on-premises. Cloud-based deployment offers scalability, flexibility, and cost-effectiveness, making it a popular choice among algorithm traders. On-premises deployment provides greater control and security over sensitive trading data.

- **By Organization Size**: The algorithm trading market can further be segmented by organization size into large enterprises and small & medium-sized enterprises (SMEs). Large enterprises often have the resources to invest in sophisticated algorithmic trading systems, whereas SMEs may opt for more cost-effective solutions tailored to their needs.

- **By End-User**: End-users of algorithm trading solutions include institutional investors, hedge funds, banks, and brokerage firms. Each category of end-users has specific requirements and objectives when it comes to algorithmic trading, driving the demand for specialized solutions in the market.

**Market Players**

- **Market Leader**: Citadel Securities, Virtu Financial, Optiver, Tower Research Capital, DRW Trading, Flow Traders, Jump Trading, Hudson River Trading, IMC Financial Markets, and Tradebot Systems are among the leading players in the global algorithm trading market. These market players have a strong presence and offer a wide range of algorithmic trading solutions to cater to diverse client needs.

- **Emerging Players**: With the increasing adoption of algorithmic trading across industries, several emerging players are making a mark in the market. Companies like AlgoTrader, InfoReach, KCG Holdings, QuantConnect, Alpaca, and QuantInsti are introducing innovative algorithms and trading strategies, expanding the competitive landscape of the market.

- **Technology Providers**: Apart from pure-play algorithm tradingIn the algorithm trading market, technology providers play a crucial role in enabling the seamless functioning of algorithmic trading systems. These technology providers offer a wide range of solutions, tools, and services to support algorithm traders in executing high-speed trades, managing risk, and optimizing performance. From advanced data analytics platforms to cutting-edge trading algorithms, technology providers are continuously innovating to meet the evolving needs of the market. They help organizations leverage the power of artificial intelligence, machine learning, and big data analytics to gain a competitive edge in the algorithmic trading landscape.

One of the key contributions of technology providers to the algorithm trading market is the development of sophisticated trading algorithms that can analyze market data in real-time, identify profitable trading opportunities, and execute trades at lightning speed. These algorithms are designed to adapt to changing market conditions, detect patterns, and make split-second decisions to capitalize on market inefficiencies. By leveraging advanced algorithms developed by technology providers, algorithm traders can automate their trading strategies, reduce human errors, and execute trades with precision and efficiency.

Moreover, technology providers offer state-of-the-art infrastructure and connectivity solutions that enable algorithm traders to access market data feeds, execute trades across multiple asset classes and trading venues, and manage their trading operations efficiently. They provide low-latency trading infrastructure, high-performance computing resources, and secure connectivity options to ensure fast and reliable trade execution. Additionally, technology providers offer risk management tools, compliance solutions, and monitoring systems to help algorithm traders mitigate risks, ensure regulatory compliance, and maintain the integrity of their trading operations.

In an increasingly competitive market environment, technology providers play a critical role in driving innovation and shaping the future of algorithmic trading. By investing in research and development, collaborating with industry partners, and staying abreast of the latest market trends, technology providers are at the forefront of driving technological advancements in algorithmic trading. They are exploring new frontiers such as quantum computing, blockchain technology, and predictive analytics to unlock new opportunities for algorithm traders and enhance the efficiency and effectiveness of trading strategies**Market Players**

- Thomson Reuters

- 63 moons technologies limited

- VIRTU Financial Inc.

- Software AG

- MetaQuotes Ltd

- Symphony Limited

- InfoReach, Inc.

- Argo Software Engineering

- Kuberre Systems, Inc.

- Tata Consultancy Services Limited

- QuantCore Capital Management, LLC

- iRageCapital

- Automated Trading Softtech Pvt. Ltd.

- Trading Technologies International, Inc

- uTrade.

- Vela Labs, Inc.

- AlgoTrader

The algorithm trading market is witnessing significant growth and evolution, driven by the increasing adoption of algorithmic trading across various sectors. The segmentation of the market based on components, deployment options, organization size, and end-users highlights the diverse needs and preferences within the market. Market leaders such as Citadel Securities, Virtu Financial, and Optiver are at the forefront, offering a wide range of solutions to cater to the demands of institutional investors, hedge funds, banks, and brokerage firms.

Emerging players like AlgoTrader, InfoReach, and KCG Holdings are introducing innovative algorithms and trading strategies, adding competition and fostering innovation within the market. Technology providers play a critical role in supporting algorithm traders with advanced tools, infrastructure, and connectivity solutions to execute trades efficiently and manage risks effectively. They are continuously investing in research and development to drive technological advancements in algorithmic trading, exploring new frontiers like quantum computing and blockchain technology.

The market for algorithmic trading is characterized by

Explore Further Details about This Research Algorithm Trading Market Report https://www.databridgemarketresearch.com/reports/global-algorithm-trading-market

Key Benefits for Industry Participants and Stakeholders: –

- Industry drivers, trends, restraints, and opportunities are covered in the study.

- Neutral perspective on the Algorithm Trading Market scenario

- Recent industry growth and new developments

- Competitive landscape and strategies of key companies

- The Historical, current, and estimated Algorithm Trading Market size in terms of value and size

- In-depth, comprehensive analysis and forecasting of the Algorithm Trading Market

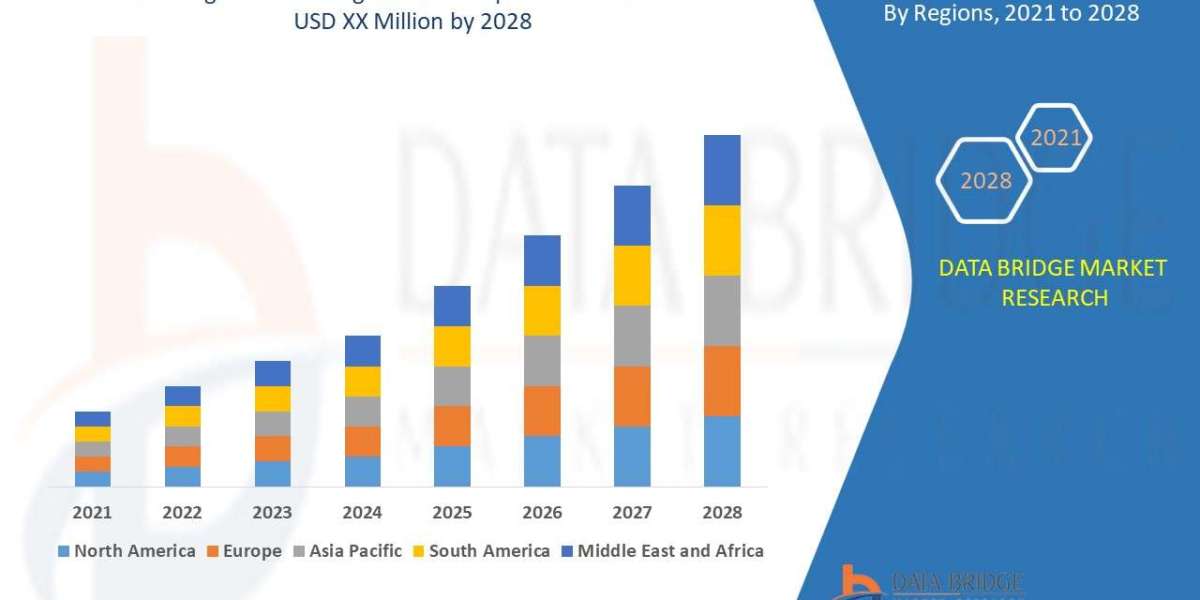

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2028) of the following regions are covered in Chapters

The countries covered in the Algorithm Trading Market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, and Rest of the Middle East and Africa.

Key Questions Answered:

1. What is the Algorithm Trading Market?

2. How big is the Algorithm Trading Market?

3. What is the growth rate of the Algorithm Trading Market?

4. What are the key drivers of the Algorithm Trading Market?

5. Which region dominates the Algorithm Trading Market?

6. Who are the major players in the Algorithm Trading Market?

7. What segments are included in the Algorithm Trading Market?

8. What are the challenges facing the Algorithm Trading Market?

9. What is the future outlook for the Algorithm Trading Market?

10. How can companies benefit from the Algorithm Trading Market?

Browse More Reports:

Platform-as-a-Service Market – Industry Trends and Forecast

Aerogel Market – Industry Trends and Forecast

C-Reactive Protein Market – Industry Trends and Forecast

Linear Alkyl Benzene Market – Industry Trends and Forecast

Luxury Car Leasing Market – Industry Trends and Forecast

Asia-Pacific Luxury Car Leasing Market – Industry Trends and Forecast

Europe Luxury Car Leasing Market - Industry Trends and Forecast

Middle East and Africa Luxury Car Leasing Market – Industry Trends and Forecast

North America Luxury Car Leasing Market - Industry Trends and Forecast

Direct Carrier Billing Platform Market - Industry Trends and Forecast

Automotive Hydraulics System Market – Industry Trends and Forecast

Diabetic Shoes Market – Industry Trends and Forecast

Tall Oil Rosin Market – Industry Trends and Forecast

Chimeric Antigen Receptor (CAR)-T Cell Therapy Market – Industry Trends and Forecast

Light-Emitting Diode (LED) Driver Market – Industry Trends and Forecast

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 978